How to Create a Trading Journal Linked to MT5 Performance Data

As a trader, one of the best skills you can master is keeping an accurate record of your trades. No matter if you are self-employed or working for a proprietary trading firm, keeping a trading journal is a good habit that distinguishes most professionals from the amateurs. We live in a digital world, and having a trading journal integrated with MetaTrader 5 (MT5) breaks the boundary of manually entering data, achieving unparalleled time savings, and providing insights captured in real-time. In today’s world, calibrating your trading journal with actual MT5 performance data elevates its accuracy and operational mastery.

The Significance of a Trading Journal for Traders in a Prop Firm

Keeping a log of your trades has various advantages. It allows traders the ability to record every trade they make, evaluate the results, analyze errors made, and track performance over time. For prop firm traders, having a journal is not just a cherry on the cake; it is a necessity. These firms assess not just the profits made, but also the level of consistency, risk control, and even the psychological factors at play. Especially during funded account assessments, a journal serves to substantiate a trader’s strategy and the behavioral discipline governing it, proving invaluable.

Numerous proprietary trading firms (prop firms) desire to gauge how a trader deals with different scenarios, including wins, losses, and periods of drawdown, in addition to the usual P&L figures. A journal which captures trading activity data from MT5 provides a more objective record of performance than self-evaluations, which often rely on personal narratives.

Why should one link a journal to MetaTrader 5?

Like its predecessor, MetaTrader 4, MetaTrader 5 remains one of the most popular interfaces for retail and professional traders. Some of its features, including algorithmic trading, backtesting, and real-time analytics, are quite sophisticated. The reporting functionalities of MT5, however, leave much to be desired when it comes to in-depth psychological tracking and qualitative analysis. While useful, they are often restricted in scope.

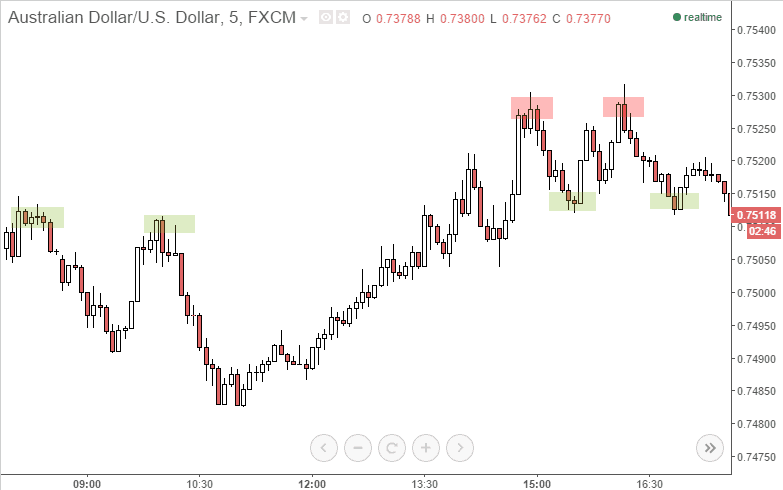

By linking a journal to performance data from MT5, one can reconcile quantitative information like trade entry and exit points, trade length, lot sizes, and profit over time with qualitative factors, including one’s state of mind, market conditions, or reasons for executing a trade. Such a combination paints a richer picture, facilitating insightful reflections and improved strategy refinement over time.

Strategies for Building a Journal Linked to MT5 Data

Depending on your skill level and the tools at your disposal, there are numerous options for creating a journal which will actively update alongside your activities in MetaTrader 5. At a more basic level, one could simply copy their trade history from MT5 into a Spreadsheet application, like Excel or Google Sheets. More advanced users could utilize APIs, scripts, or even third-party services to fully automate the integration.

The MT5 platform has integrated features aimed at exporting trading data to a diverse range of templates such as HTML, CSV, or XML. These files can then be worked upon with self-designed spreadsheets and customized journaling applications. As an illustration, a CSV containing trade history can be set to automatically populate fields with date and time of trade, symbol, direction, entry price, stop loss, take profit, result and many more. You can further add your own customized columns, such as your confidence level, trade thesis or post-trade review comments.

Integrating MT5 Data with Excel or Google Sheets

One of the simplest ways to incorporate MT5 data into a trading journal is to utilize Google Sheets or Microsoft Excel. You can export your MT5 trading history and save it as a CSV file. From there, you can use various formulas and macros to calculate and visualize historical performance metrics. For example, you can perform metrics such as average R:R ratio, win rate, expectancy, or adherence to trading plans.

Besides, the cloud-based nature of Google Sheets makes it more user-friendly since journals can be accessed from any device. Google Apps Script can also be used to automate tasks, set up dashboards, or even send emails if certain trading conditions are met. Prop firm traders can make use of these tools to keep automated, professional, and well-documented trading records.

Automated Journaling Using Scripts or Expert Advisors

Providing you have some knowledge of MQL5, the MetaTrader 5 language, you can purchase or code your own Expert Advisors (EAs) or scripts that log trading information into a database or spreadsheet on an external server automatically. For instance, an EA can set up an API, and every time a trade is executed, it sends the trade information to a Google Sheet. In this manner, complete automation is possible whereby no trade can be missed and data can be captured with absolute certainty.

Apart from the trade details, these scripts can capture a lot of other information. Market conditions at the time of entry, volatility measurements, indicator values, or even the current account drawdown which could be programmed. Such data is invaluable when analyzing performance trends, streaks, and understanding winning or losing streaks.

Integration With Third Party Journaling Services

Edgewonk, TraderVue, Myfxbook, and Forex Factory Trade Explorer are some of the external services that offer trade journaling and integrate with MetaTrader 5. These services enable exporters to synchronize their MT5 accounts and view the information in numerous ways. Unlike MetaTrader 5, these services provide sophisticated analytics such as analytics stratified by trade type, session, strategy, and instrument.

For prop firm traders, these platforms usually capture the depth of reporting prop firms look for during evaluations. Equity curves, risk analysis, drawdown tracking, and daily summary performance reports can serve as a personal accountability mechanism and a professional display of one’s trading skills.

Enhancing Self-Analysis with Qualitative Insights

Numerical data is fundamental, but the most powerful trading journals include qualitative insights. Those are the notes you take on your feelings, reasoning about the market, and your mental condition during the trade. This sort of journaling uncovers behavioral patterns that absence of data analysis might miss, such as rule breaking due to overpowering winning, or irrational for volatile market moves.

Such notes should either pre or post a trade be seamlessly added through the use of a journal associated with MT5. Various EAs and other applications offer comment on trade function, while others that are spreadsheet based give provision for “notes” cells. What is pivotal is looking for ways to foster the culture of answering the question, ‘what did I learn even when winning a trade?’.

Analyzing journals in order to widen your perspective

Keeping records of your trades is only part of the journaling process; true value emerges only due to regular reviews. This is even more crucial for prop firm traders, who, as one of the many expectations, have to show constant improvement over time in the form of strategy refinement and emotional control. A properly maintained journal provides the opportunity for weekly or monthly checks where one could evaluate their performance, identify patterns of persistent issues, and set objectives for the subsequent trading cycle.

Using MetaTrader 5, visual backtesting and chart replay tools allow traders to revisit trades. These tools, in conjunction with MetaTrader 5 trade history, provide traders the opportunity to confirm whether their predetermined trade setup adhered to their strategy rules, or if they need to adjust their entry or exit points.

A journal as a professional edge

In the context of prop firm trading, where capital allocation decisions depend heavily on sharp performance indicators and unfailing self-discipline, a trading journal synced with MetaTrader 5 data becomes a weapon of professional warfare. A trading journal will not only boost one’s personal performance but will also show prop firms that they are organized and reliable.

A trading journal can be the most effective trading instrument for professional market players. Unlike any other resource, it captures in detail how they evolved over time, their strategies, as well as their struggles and successes. When accompanied by real time MT5 data, it provides data verification and accountability.

Final Thoughts

Connecting a trading diary with MetaTrader 5 performance data is perhaps one of the best decisions a trading professional can ever make. This not only improves accuracy but also saves time while providing greater understanding of trading activities and the effectiveness of strategies employed. For traders who are already working at a prop firm or those who want to join one, this tool serves as a great support in sustaining the firm’s rigid requirements for transparency, risk management, and consistent performance.

Through automation, use of technology and honest self-evaluation, the trading journal becomes a fundamental building block for a trader’s success by transforming information into insights that drive action for achieving sustained profitability over time.