Gold Futures Trading Strategies in Volatile Markets

Gold futures have long been a preferred instrument for traders seeking opportunities in the commodity markets, especially during times of economic uncertainty. As global events create volatility across financial markets, gold often serves as a safe haven asset—making it both a defensive play and a high-opportunity trade. In this article, we’ll explore some of the most effective futures trading strategies tailored for volatile markets, with a specific focus on gold futures.

Why Gold Futures Are Ideal for Turbulent Markets

Turbulent markets are characterized by high-speed price action and uncertainty—typically triggered by geopolitical tensions, economic data releases, inflation fears, or surprise central bank policy moves. When this occurs, gold tends to attract capital due to its long-standing role as a safe store of value.

Gold futures—tradeable, standardized contracts like those on the COMEX (a CME Group subsidiary)—allow speculators to bet on the future price of gold without taking physical delivery. These contracts are leveraged, meaning a small margin payment grants access to a large position size—magnifying both gains and losses.

This leverage, combined with gold’s sensitivity to market catalysts, makes it a top pick in a volatile trading environment.

1. Breakout Trading Strategy

In volatile markets, price often moves swiftly through key levels of support or resistance. A breakout trading strategy seeks to capitalize on these rapid moves by entering trades as price breaks out of a defined range.

How It Works

- Identify a consolidation pattern or chart formation (e.g., triangle, flag).

- Place a buy stop order above resistance or a sell stop order below support.

- Use tight stop-loss orders to manage risk effectively.

Why It Works for Gold Futures

Gold tends to respond aggressively to major macroeconomic events (e.g., U.S. interest rate decisions, geopolitical crises). These events create perfect breakout opportunities in gold prices.

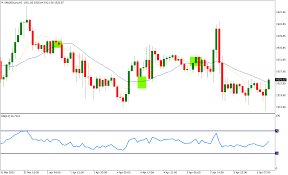

2. Momentum Trading

Momentum trading involves entering positions when there is strong directional price movement supported by volume and sentiment.

How to Use It

- Confirm trend direction using indicators like RSI, MACD, or moving averages.

- Enter trades based on strong candlestick patterns or confirmed trend signals.

- Exit positions when momentum slows or price nears significant support/resistance.

Example

During inflationary spikes, gold often rallies. A momentum trader could buy into the rally after confirmation and ride the move until signs of exhaustion appear.

3. Mean Reversion Strategy

Despite its volatility, gold often returns to its average price over time. A mean reversion strategy seeks to profit from excessive deviations from this average.

Strategy Setup

- Use tools like Bollinger Bands or moving average envelopes to identify extreme price levels.

- Enter short trades when the price is far above average and long trades when it’s far below.

- Utilize small position sizes and tight stop-losses to control risk.

When to Use

Best during extended volatility where price is likely to correct—but risky during strong trends. Combine with other indicators for confirmation.

4. Hedging Strategy

A more conservative approach in volatile markets is hedging, where traders use gold futures to offset risk in other asset classes (e.g., equities, currencies).

Example

If you hold a portfolio of USD-denominated assets and fear a drop in the dollar’s value, taking long positions in gold futures can act as a hedge, since gold typically rises as the dollar weakens.

Who Should Use This

Ideal for institutional investors or long-term traders seeking to protect capital rather than speculate.

5. News-Based Scalping

News-based scalping involves taking rapid trades during major economic releases, such as CPI data, Fed rate announcements, or employment reports. Gold is extremely reactive to such news, often moving dramatically within minutes.

Tools Needed

- A reliable economic calendar to track high-impact news.

- Focus on short timeframes like 1-minute or 5-minute charts.

- Place quick market or limit orders during the news window.

Caution

This strategy requires fast execution, minimal slippage, and solid internet connectivity. It’s high-risk, but can be highly rewarding in the right hands.

Risk Management Tips for Gold Futures Trading

Trading gold futures in volatile markets can be extremely lucrative—but also risky. Here are key tips for managing that risk:

- Use Stop-Loss Orders: Always define your maximum risk before entering a trade.

- Adjust Position Size: Reduce size during periods of increased volatility.

- Avoid Overleveraging: Use conservative margin to limit exposure.

- Monitor Margin Requirements: Maintain sufficient funds to avoid margin calls.

- Stay Updated: Follow financial news, central bank updates, and economic calendars.

Conclusion

Trading gold futures during volatile markets offers unique opportunities for well-prepared traders. Whether you prefer breakout, momentum, mean reversion, or hedging strategies, the key is to remain adaptive, disciplined, and data-driven.