Business Banking Account: Elevate Your Financial Strategy Today

Opening a business banking account isn’t just a formality—it’s a strategic move that can significantly impact your company’s growth and financial health. Whether you’re a start-up entrepreneur or a seasoned business owner, the right account can streamline your cash flow, simplify tax preparation, and offer valuable financial insights.

But with so many options available, how do you choose the best fit for your needs? From transaction fees to customer service, there’s a lot to consider. In this article, we’ll guide you through the essentials of selecting a business banking account that aligns with your goals, ensuring you make an informed decision that benefits your business in the long run.

What Is A Business Banking Account?

A business banking account serves as a dedicated financial repository for your company. Unlike a personal account, it keeps business finances separate, helping you easily track and manage incoming and outgoing funds. This separation simplifies expense reporting and tax preparation.

Business accounts often come with features tailored to meet the needs of companies. You might find services such as payroll processing, merchant services or financial analytics tools included. These features assist in daily operations and long-term planning.

Business banking accounts come in various forms. Current accounts usually handle day-to-day transactions, while savings accounts help manage reserves. You may also need a foreign currency account if your business deals internationally. Each account type offers unique benefits, depending on your specific requirements.

Opening a business banking account involves some documentation. Banks typically ask for identification, business registration certificates, and proof of address. This process ensures they understand your business structure and needs before offering services.

Have you ever wondered how these accounts can assist in credit building? Maintaining a good track record with a business account might improve your creditworthiness, making it easier to secure loans or lines of credit.

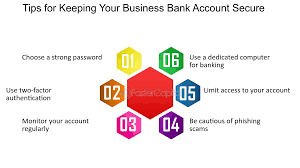

Security is another critical aspect. Business accounts often include advanced security features to protect against fraud and cyber-attacks. Ensuring your company’s funds are secure gives you peace of mind.

Why might you choose a business banking account over a personal one? Consider the benefits—streamlined cash flow, simplified taxes, and professional credibility. With a dedicated account, your business may appear more legitimate to clients and suppliers, fostering trust and reliability.

Would you like to know what types of business banking accounts exist? Here’s a quick rundown:

- Current Accounts: Manage daily transactions and expenses.

- Savings Accounts: Build reserves with interest.

- Merchant Accounts: Facilitate credit and debit card transactions.

- Foreign Currency Accounts: Conduct international transactions without currency exchange hassles.

Does your current account meet your business needs, or is it time to explore new options? Evaluate available services to ensure alignment with your financial goals.

Types Of Business Banking Accounts

Understanding the different types of business banking accounts helps you manage your finances effectively. Choosing the right account type can greatly impact your company’s financial health.

Current Accounts

Current accounts handle daily business transactions effortlessly. They provide features like cheque books, overdraft facilities, and debit cards, making it easy for you to manage day-to-day expenses. Do you need to write cheques regularly or perform many transactions? A current account might be the ideal match. Most banks also offer online and mobile banking services for real-time transactions and account management. Keep an eye on the fees associated with transactions and overdrafts to avoid unexpected costs.

Savings Accounts

Savings accounts are perfect for storing excess funds safely while earning interest. These accounts don’t usually offer cheque books or overdraft options but come with higher interest rates than current accounts. You can consider a savings account if your business often has surplus cash. Is your aim to build a reserve for future expenses or unforeseen emergencies? A savings account might be the right choice. Ensure you understand the deposit and withdrawal limits, as restrictions can apply to maintain the account benefits.

Fixed Deposit Accounts

Fixed deposit accounts offer higher interest rates in exchange for locking funds for a specific period. They’re ideal when you have a lump sum that you won’t need access to immediately. By investing in a fixed deposit account, you not only earn significant interest but also ensure that your funds remain secure for the agreed term. Are you looking to grow your long-term savings? Consider the tenure and penalties for early withdrawal, as these factors can affect the overall returns on your investment. Explore these account types to find which aligns best with your business needs, ensuring financial stability and growth.

Key Features To Look For

A business banking account can offer numerous features to support your financial operation. Understanding these features will help you choose the right account.

Overdraft Facilities

Overdraft facilities provide flexibility when cash flow fluctuates. You can cover expenses even when funds run low. For instance, during slower business periods, an overdraft can be invaluable. It’s essential to check the terms, such as interest rates and limits. Think about how often your business might need this safety net. Should you find frequent shortfalls in your finances, an overdraft could prevent missed payments and costly fees.

Online Banking

Online banking enhances convenience and accessibility. You can manage transactions, check balances, and transfer money at any time. Most banks offer robust online services, including mobile apps for on-the-go management. Consider how mobile functionality may benefit you during travel or meetings. Security is another critical aspect; look for features such as two-factor authentication. If ease of access and security are priorities, online banking capabilities should be at the top of your list.

Integration With Accounting Software

Integration with accounting software streamlines financial management. Directly linking your account with software like QuickBooks or Xero ensures all transactions are automatically recorded. This feature reduces manual entry errors and saves time. Evaluate which software your business uses, and verify compatibility with the bank. If automation and accuracy in your bookkeeping are non-negotiable, seamless integration will be crucial.

Benefits Of A Business Banking Account

Considering a business banking account? It might manage your finances better.

Separate Personal And Business Finances

Separating personal and business finances is crucial. Confusion evaporates when there is a dedicated account for your business. It simplifies tracking expenses and identifying deductions. Clear records can help during tax time. Isn’t it easier when your business expenditures don’t intertwine with personal ones?

Enhanced Financial Management

Having a business banking account enhances financial management. You can monitor cash flow more effectively. Tools and reports keep you informed about where money goes. Doesn’t integrated accounting software make bookkeeping simpler? Pay suppliers and employees promptly, maintain appointments with fiscal responsibilities, and avoid any financial chaos.

Access To Business Loans And Credit

Need funds for expansion? A business banking account might be your gateway to loans and credit lines. It builds your business credit history, creating trust with financial institutions. These institutions may offer credit cards, loans or overdrafts tailored to your business needs. Curious if your business qualifies for better loan terms? Financial history in a business account could be the key.

Final Thoughts

A business banking account isn’t just a convenience; it’s a necessity for any growing company. By separating your personal and business finances, you can streamline expense tracking and simplify tax preparation. You’ll also gain access to essential financial tools and reports, making it easier to manage your company’s finances effectively.

Having a business banking account opens doors to business loans and credit lines, which are crucial for growth. It helps you build a solid business credit history, paving the way for better financial opportunities in the future. Prioritise your business’s financial health by choosing the right banking account today.