Mastering Money Management: The Role of Professional Bookkeeping Services

Bookkeeping Services

Effective money management is the cornerstone of financial success for any business. From tracking expenses and revenues to managing cash flow and preparing financial statements, meticulous bookkeeping is essential for maintaining financial health and making informed decisions. In this article, we’ll explore the critical role of professional bookkeeping services in mastering money management and optimizing business operations.

Accurate Financial Recordkeeping

At the heart of professional bookkeeping services lies accurate financial recordkeeping. Professional bookkeepers meticulously record all financial transactions, including sales, purchases, expenses, and payments, using standardized accounting methods. By maintaining up-to-date and accurate financial records, businesses gain valuable insights into their financial performance, enabling them to make informed decisions and assess their financial health effectively.

Organized Expense Tracking

Tracking expenses is vital for controlling costs and maximizing profitability. Professional bookkeepers categorize and track expenses systematically, providing businesses with a clear overview of their spending patterns and areas for cost optimization. From payroll and utilities to supplies and overhead costs, organized expense tracking allows businesses to identify inefficiencies, eliminate wasteful spending, and improve budgeting strategies.

Revenue Management and Invoicing

In addition to tracking expenses, professional bookkeeping services also manage revenue streams and invoicing processes. They ensure timely invoicing, accurate recording of sales transactions, and prompt follow-up on outstanding payments. By maintaining a streamlined invoicing process, businesses can improve cash flow, reduce outstanding receivables, and enhance their financial stability.

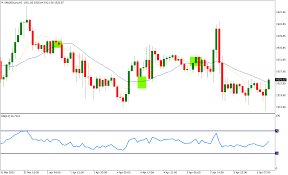

Cash Flow Monitoring and Forecasting

Cash flow management is critical for sustaining business operations and facilitating growth. Professional bookkeepers monitor cash flow regularly, tracking incoming and outgoing funds to ensure liquidity and solvency. They analyze cash flow patterns, anticipate future cash needs, and develop cash flow forecasts to help businesses make informed decisions about investments, expenses, and financing options.

Preparation of Financial Statements

Financial statements provide a snapshot of a business’s financial performance and position, enabling stakeholders to assess its profitability, liquidity, and solvency. Professional bookkeeping services prepare accurate and timely financial statements, including income statements, balance sheets, and cash flow statements. These statements serve as essential tools for financial analysis, strategic planning, and compliance with regulatory requirements.

Compliance with Tax Obligations

Tax compliance is a top priority for businesses to avoid penalties, fines, and legal repercussions. Professional bookkeepers ensure that businesses comply with tax regulations by maintaining accurate records, calculating taxes owed, and preparing tax returns. By staying abreast of tax laws and deadlines, they help businesses fulfill their tax obligations efficiently while minimizing tax liabilities and maximizing deductions.

Financial Analysis and Reporting

Beyond day-to-day bookkeeping tasks, professional bookkeepers provide valuable financial analysis and reporting services. They interpret financial data, identify trends and patterns, and generate meaningful reports to help businesses understand their financial performance and make informed decisions. Whether it’s assessing profitability, evaluating investment opportunities, or planning for growth, their financial expertise adds significant value to business operations.

Strategic Financial Planning

Professional bookkeeping services play a crucial role in strategic financial planning for businesses. They collaborate with business owners and stakeholders to develop comprehensive financial plans, set achievable goals, and implement strategies to optimize financial performance. From budgeting and forecasting to risk management and investment planning, their insights and expertise guide businesses toward long-term financial success.

In conclusion, professional bookkeeping services are indispensable for mastering money management and achieving financial success. By providing accurate recordkeeping, organized expense tracking, cash flow monitoring, compliance with tax obligations, and strategic financial planning, they empower businesses to make informed decisions, maximize profitability, and thrive in today’s competitive landscape. Investing in professional bookkeeping services is not just a cost but a strategic investment that yields significant returns in the form of improved financial health and sustainable growth.

Looking to streamline your financial processes and gain clarity on your business’s financial health? Turn to Source Accounting for comprehensive bookkeeping services that drive efficiency and accuracy. Our team of skilled bookkeepers meticulously track and record your financial transactions, ensuring that every penny is accounted for with precision. From organizing expenses and managing invoices to reconciling accounts and generating financial reports, we handle all aspects of bookkeeping with expertise and attention to detail. With Source Accounting by your side, you can focus on growing your business while we take care of the numbers. Partner with us today for reliable bookkeeping solutions that lay the foundation for your business’s success.